I’ve focused on bear markets for the last two weeks because the stock market briefly dipped into bear market territory a few weeks ago. Since then, markets have recovered some of what was lost, although there is still a way to go to get back to even.

One of my colleagues pointed out that as long as your portfolio could reliably provide the cash flow that you need to live on and still have enough capital to enjoy the recovery when it comes, a bear market should be manageable.

And that’s what our financial planning is all about. The Wall Street Journal published an article last week, titled ‘The Best Retirement Spending Advice from Our Readers, which you can access here if you have a subscription.

The article had a lot of good tips, including planning on being surprised by some expenses, keeping a rainy-day account, and keep budgeting in retirement.

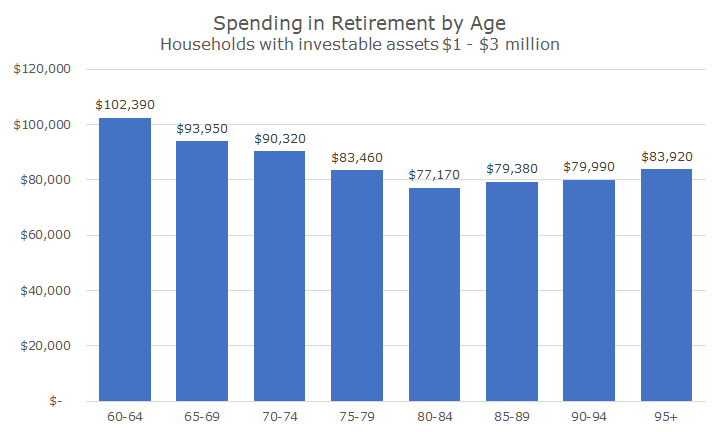

It also included a chart based on data from JP Morgan that I thought was helpful, so I recreated it below.

As you can see, the chart shows average spending by decade for retirees, and it shows something we all understand intuitively and that we’ve seen for decades: people spend less as they get older.

Part of what caught my eye was in the caption, which said that this was based on people that have investable assets of $1-3 million, and a lot of our clients fall into that category. And, sure enough, a lot of our clients live on roughly the amounts listed in the chart.

We’ve been working with these models for 20-years, and have learned some useful lessons, including those listed in the WSJ.

First, how much you spend in retirement is the second most important decision you can make when planning for your retirement. The most important is when you stop working because that is the point where you stop adding to your savings and start drawing on your savings.

Shifting your retirement by a few years in either direction can have a big impact on your retirement. We do our best to plan around this date, including a bear market test that shows the impact of a 20-percent market drop upon retirement (which we’re adjusting a little bit to reflect the bond market losses).

But you don’t always control when you retire – about a third of people retire earlier than planned due to health issues, according to the Employment Benefit Research Institute.

Of course, once you’re retired, how much you spend in retirement becomes the most important factor to your success, and, just as importantly, the only one in your control. Our asset allocation is under our control, but we’re powerless over stock and bond returns and inflation.

I’ll share one of the planning tricks that I use with clients that build in a little conservatism. Even though I know that people tend to spend less with age, I tend to leave the spending constant over time (adjusting for inflation, but you don’t really see that in the model even though it’s there).

I’ll often talk about how people spend less, and show what that might look like, but when I talk about it, most people want to leave the constant spending knowing that it isn’t likely to be true. To some degree, that’s hedging for unexpected healthcare costs, but our planning already includes that too.

Also, a lot of people add to their expenses in the first 10-years of retirement and call it travel, which is a nice way to look at it.

Usually, our clients want to be able to maintain their lifestyle with a little cushion, so that they don’t have to worry when inflation comes in hotter than expected, or if their stock or bond portfolio takes a hit since we all know these things happen.

And planning in retirement is useful too. No matter your current age, it often helps to take a look at your plan in moments like this to make sure that you’re still on track. More often than not, it’s comforting and worth the time and effort, and then you can get back to doing what you like to do.