The investment management industry has been dominated by just a small handful of trends over the last decade: the growth of passive versus active funds, the birth of alternative strategies in mutual funds, the explosive proliferation of exchange traded funds (ETFs) and the overwhelming acceptance of target-date funds.

Of those topics, the only one that I haven’t already covered (as denoted by the blue hyperlink) is the overwhelming acceptance of target-date fund (TDFs).

The basic idea of a TDF is that it is a ‘one-stop-shop’ for investors who want a simple, diversified portfolio that reduces risk over time that roughly corresponds with their retirement date.

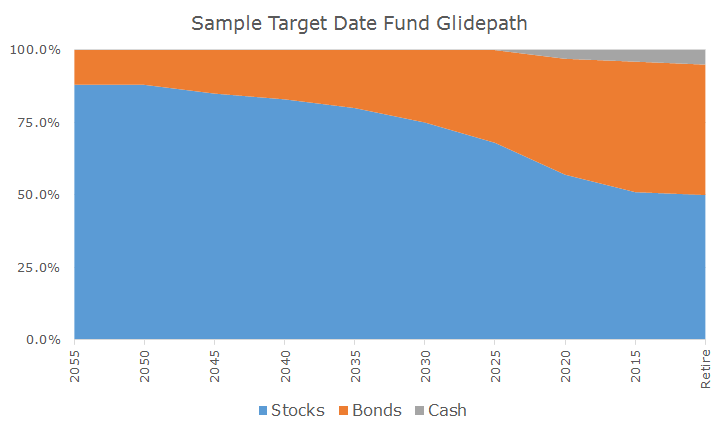

The portfolio is automatically adjusted over time on what is referred to as a ‘glidepath’ that reduces stocks and increases cash and bond exposures to reduce overall risk. The following chart is a sample glidepath that gets the basic idea across, although different firms use various approaches.

Ten years ago, the TDF segment of the market was relatively small with less than $100 billion in assets under management. Today, when you include ETFs, that number is over $1 trillion.

A lot of people have criticized the TDF industry, although a lot of the argument was based on the fact that TDFs fell substantially in the 2008 financial crisis. The Vanguard Target Retirement 2010 fund fell -20.67 percent in 2008 and that particular fund was designed for those about to enter retirement.

Personally, I think that’s a silly argument because everything lost money in 2008! No one is saying that TDFs don’t have risk – they most certainly do! Even though that fund was for people on the precipice of retirement, those same people still have a time horizon that should be measured in decades, so they can afford to take some losses with the hope of higher return.

By the end of 2010, investors in that fund had earned back all of their losses and over the last five years, the fund has gone on to earn just over eight percent per year. I don’t hear as many critics today as I did right after the crisis, probably because investors realized that these funds were working and voted with their feet.

In fact, the reason I decided to write an article today about TDFs was a very encouraging bit of research from Morningstar which shows that in the aggregate, investors are using TDFs more responsibly than other types of funds.

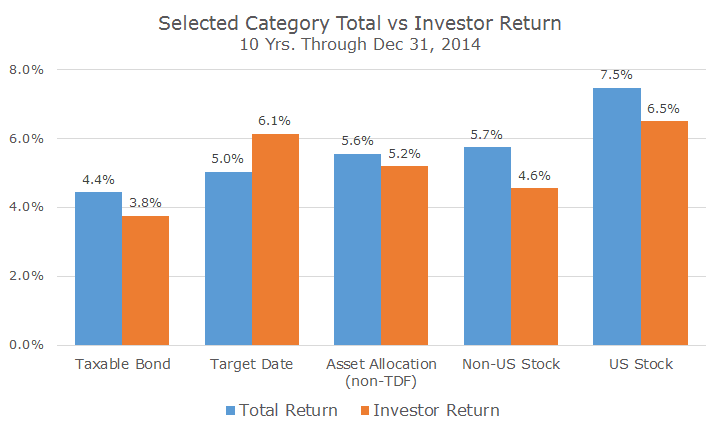

The study looked at the difference between the total return of mutual funds compared to what the investors actually earned in those funds based on the timing of their deposits and withdrawals.

If investors simply own a fund without any additions or subtractions to their account, the investor will earn the total return. Unfortunately, what we see in the real world is that investors chase returns, buying them after they have gone up and selling them after they have gone down, shooting themselves in the foot.

I’ve written a more detailed explanation here (and Morningstar’s detailed calculation methodology can be found here), but you can basically think of the difference between the total return and investor return as a behavior gap.

The good news about TDFs is that, unlike any of the other funds categories that Morningstar reported on, the behavior gap was positive with TDFs.

Notice on the far right, for the US stock section, the total return for US stock mutual funds was 7.5 percent – investors lost one percent per year over a decade based on their own bad behavior.

That basic pattern is found in every category except for TDFs where the total returns for the funds was five percent, but the TDF investors earned 6.1 percent.

How did that happen? Because the TDF investors were mostly 401k account holders and were disciplined about adding to their accounts before, during and after the financial crisis.

Although we generally don’t use TDFs, preferring to build our own allocations and populate those allocations with our own mix of individual securities, ETFs and mutual funds, we think they make sense for a lot of investors, particularly those with smaller balances.

For the 401k plans that we manage, we use software to create our own versions of TDFs for a variety of reasons including lower costs, less confusion for participants and better diversification within the allocations.

Still, it’s nice to see a Wall Street creation working for investors instead of against them.