One of the hottest trends in investing over the past five to ten years has been investing in master limited partnerships (MLPs).

As the name states, an MLP is a limited partnership that is somehow engaged in the natural resources business. MLPs engage in the exploration and development (upstream), processing and transportation (midstream) and distribution and marketing to end consumers (downstream) of products like timber, coal, minerals, oil natural gas and liquid natural gas.

MLPs have attracted a lot of attention and investor dollars in recent years because the dividends (or distributions, really, but I will get to that) are very high, the American energy renaissance has propelled growth, and MLPs generally have enjoyed relatively modest correlation with stocks and bonds (around 0.5 for you geeks out there).

What’s not to like? Well, for us, we didn’t want the trouble that comes along with being in a partnership. There are definitely tax benefits to the distributions that are great, but investors are subjected to K1s instead of 1099s, which usually come out in March or April when most people want to be done with their taxes.

With super-low interest rates, investors flocked to the high yields, which are currently around 7.5 percent. They aren’t exactly dividends, though; they are partnership distributions to unit-holders (usually known as shareholders).

Usually, a large portion of the distribution qualifies for tax-deferral, which means that you don’t have to pay taxes on a good deal of the payment, making the high yield even more attractive.

The deferral isn’t a free lunch, though, because your cost basis is reduced and if you sell the MLP, the amount that you deferred comes back as a capital gain, but is taxed as ordinary income. As a result, the best tax planning for an MLP is death.

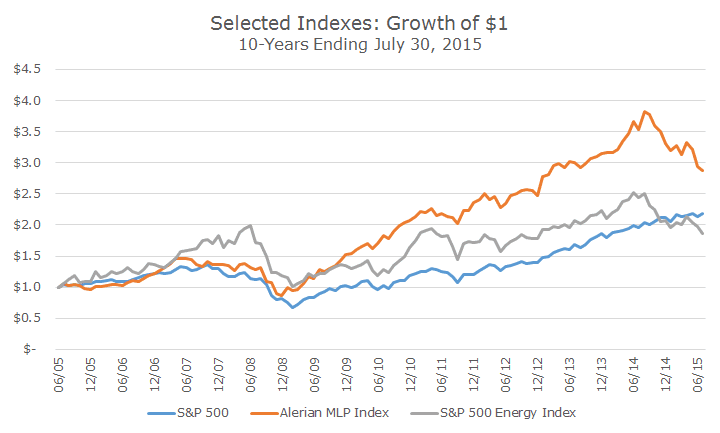

On top of the attractive distributions, the value of most MLPs has increased substantially, until recently. As you can see in the chart below, MLPs are suffering a material selloff and are easily in bear market territory, largely due to the possibility of higher interest rates and lower oil prices.

While MLPs have still outperformed stocks over the last 10-years by a solid margin, investors who got in any time after mid-2013 may be feeling a little anxious.

If investors bought MLPs to diversify their portfolio thanks to the relatively low correlation properties to stocks, than the selloff isn’t a problem. In fact, stocks have been strong while MLPs have been weak, so the correlation is ‘working’ even though MLPs are suffering right now.

If investors bought MLPs because of the yield, the recent downward prices may be a good reminder of why reaching for yield can be problematic. Investors who leave bonds for the higher yields of REITs, utilities stocks or MLPs often forget that it’s easy to lose 25 percent or more in these products.

If investors bought MLPs because they still have great long-term prospects, then there may be nothing to worry about. Honestly, I don’t know enough about MLPs to say how they will fare, but if I had to guess, I would assume that we will still need energy infrastructure and while upstream MLPs may suffer while energy prices are weak, midstream and downstream firms may do well.

Personally, I feel like we dodged a bullet with MLPs because we really didn’t give them serious consideration until what has turned out to be the recent top of the market.

You could reasonably say that our reasons weren’t good, that we wanted to avoid the nasty tax paperwork and delays, but as we sit today, I’m happy that we didn’t pull the trigger.

That said, there is a bit of karma in the investment world and if the correlation relationship holds in the future, it may well be that when stocks finally do sell off, MLPs will be riding high.