As expected, the Federal Reserve Open Market Committee (FOMC) left short-term interest rates unchanged yesterday.

Their statement yesterday along with other comments from Fed officials imply that the Fed is on course to raise rates later this year, citing solid job gains and lower unemployment.

Specifically, the statement yesterday added the word ‘some’ to a key phrase: ‘The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen SOME further improvement in the labor market and is reasonably confident that inflation will move back to its two percent objective for the medium term.’

Adding the word ‘some’ (my emphasis in the previous paragraph) suggests that less improvement is needed today than in previous meetings, which is ultimately a baby step towards raising rates in the near future.

Earlier this month, Fed Chair Janet Yellen told Congress that ‘if the economy evolves as we expect, economic conditions likely would make it appropriate at some point this year to raise the federal funds target.’

At this point, there are only three meetings left this year: September, October and December. Economists believe that the Fed is on course to raise rates at the next meeting: a full 82 percent of 60 economists surveyed by the Wall Street Journal believe that lift off will occur in September (December is the next most popular forecast at 15 percent).

Markets aren’t in agreement as signaled by prices from the futures markets. Investors (with money on the line, unlike those economists) think that the odds of a September liftoff is 38.6 percent, 45.9 percent in October and 69.7 percent in December.

The Fed statement was upbeat partly because they didn’t mention the Greek debt crisis or the Chinese stock market volatility. While the Greek situation isn’t likely to impact our economy regardless of what happens, a slowdown in the Chinese economy could put downward pressure on the global economy.

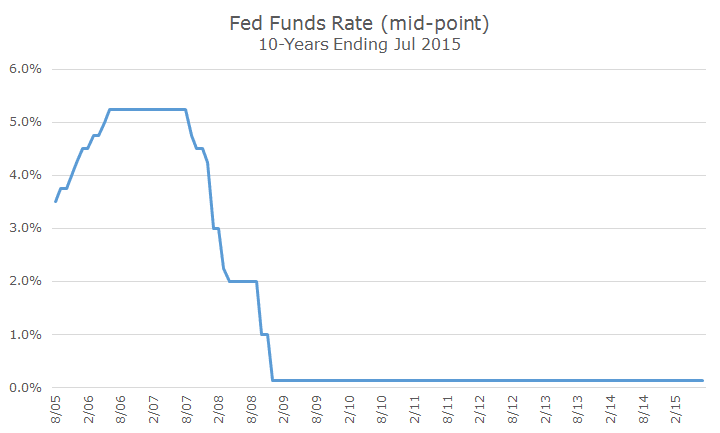

It’s been more than six years of the Fed’s zero interest rate policy (ZIRP), but the end appears to be in sight. Personally, I welcome higher rates as a sign that the economy is getting better and that the financial repression that savers have endured for so long will begin to lessen.

There is likely to be some volatility when rates actually go up even though the move has been so well telegraphed by the Fed, but as I like how Lloyd Blankfein, the CEO of Goldman Sachs put it, ‘it will be jarring when we see an interest rate hike because we haven’t had some for some time, and then I think people will get out the smelling salts, take a big sniff and recover.’