In the old active-versus-passive debate, the S&P 500 serves as the champion fighter in the passive corner. That’s funny, because the S&P 500 is hardly passive.

For example, it’s not a list of the largest 500 companies, but a curated list of stocks chosen by the index committee at Standards & Poor’s. Most of the differences between the index and the actual list of the largest 500 companies are relatively small.

That said, the largest exclusion from the bellwether index was Warren Buffett’s Berkshire Hathaway, which wasn’t added to the index until 2010, despite being one of the 10 largest publicly traded companies in the index.

In September, S&P will further prove that the their most famous index isn’t passive when they shake up their sector classification system. The smallest sector, Telecommunications, will change its name to Communications and stocks from the Technology and Consumer Discretionary sector will be reclassified as Communications.

This isn’t the first time they’ve done this kind of reclassification. Just last year, they split Real Estate Investment Trusts (REITs) from Financials into their own, standalone sector (which, incidentally, will be the smallest once Telecom is restructured).

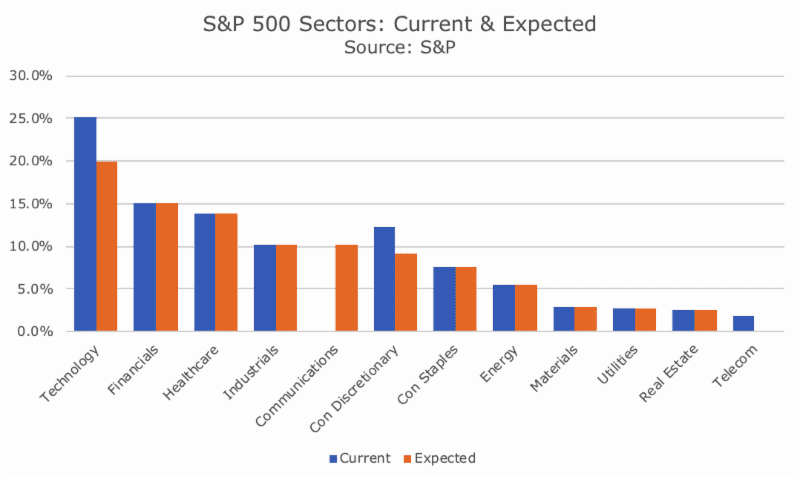

The chart below shows the current and expected sector weights based on the reclassification:

The change may not look like much in the chart above, but it affects eight percent of the total S&P 500 market cap, cuts the Technology sector by 21 percent and the Consumer Discretionary sector by 25 percent. Moreover, the Communications sector will become the fourth largest sector, behind Technology, Financials and Healthcare.

When you look at the stocks in the reclassification, there is a common thread in that the stocks are mostly media content, media-delivery or advertisers. For example, the three largest stocks moving out of Consumer Discretionary and into Communications are Comcast, Disney and Netflix. The largest Technology stocks making the shift are Alphabet (parent of Google) and Facebook.

One of the most interesting outcomes of the change is that Amazon, currently the largest share of the Consumer Discretionary Sector will become an even larger part of that sector. My calculations suggest that it will go from being 22.0 percent of the sector to 29.5 percent – a whopping 34 percent jump!

It’s hard to know how Amazon should fit into the sector classification system at this point. As a bookseller, Consumer Discretionary makes perfect sense, but now that their cloud business had become so large, shouldn’t they be in Technology? What about their acquisition of Whole Foods or their desire to get into Healthcare? (A quick aside: this paragraph makes me wonder whether the conglomerate of the 1970s is back).

For the portfolios that have individual stock positions, we are going to have to put on our thinking caps. Right now, we equally weight the seven largest sectors, which doesn’t include Telecommunications.

Since Communications will be a large sector, it seems to me that we’ll allocate towards it, although we haven’t spent much time on this subject in our Investment Committee meetings.

Fortunately, or unfortunately, there is no back test that will allow us to optimize based on past performance. An interesting question will be how this affects our overall value tilt.

S&P is keeping mum on a lot of the details, but it appears that the new Communications sector will have a pretty strong growth tilt. S&P thinks that it will be about 58 percent growth oriented and only 22 percent value (the remainder in blend, using Morningstar definitions).

We look for the stocks with the best companion of value and quality in each sector, and if the whole sector has a lot of growth, then we’ll look like more growth overall. The current Telecommunications sector is 100 percent value, but we’ve historically excluded it because it’s so small.

In any case, we’ll be spending the summer contemplating the best course of action as we learn more about the upcoming changes. One of my favorite clients often talks about how it’s important to use good judgement in the decision making process, and, of course, we’ll be doing just that.