Long time readers know that I’ve been cautious on US stocks for some time, calling them overvalued in 2014.

Last year, I referred to a quote from Sir John Templeton, who famously said that ‘Bull markets are born on pessimism, grow on skepticism, mature on optimism and die in euphoria.’

I said then that I could see the rally continuing on for years but that we were probably moving from the second to the third phase, skepticism to optimism, which meant mature growth.

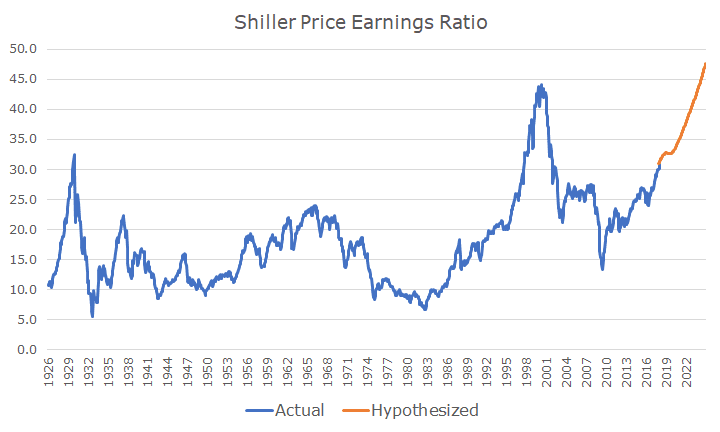

As we end 2017 with the S&P 500 up over 20 percent and volatility at record lows, it made me wonder what a move into euphoria might look like. More specifically, I wondered what it would take to get the Shiller PE ratio, which is now at its second highest level in history, to new records.

The chart below shows the actual Shiller PE ratio, in blue, and a look at how the Shiller PE ratio could go a lot higher, in orange. Let me be clear: it’s not a forecast, prediction or representative of what I think will happen. It’s just a look at what it would take break the high valuation record set in 1999.

Here’s the scenario that I came up with to break the old record: each year, stocks earn 12 percent, earnings grow by five percent and inflation stays at two percent. In my view, none of these assumptions is very outrageous and, if those things happened, the Shiller PE would jump to new records in 2024.

As I said above, I don’t think this is how stocks will play out, but it does show that stocks could go much higher for much longer. That’s why I didn’t think we should sell stocks in 2014. Stocks are more than 30 percent higher since then and I still don’t think we should sell stocks.

As always, I think we would set stock/bond allocations that we can live with through thick and thin, rebalancing along the way, which when stocks are rising means taking a little money off the table and putting it into something much safer, bonds.

It’s a process that’s worked for us for 15 years now, through two devastating bear markets and the ensuing recoveries. We think that it will be just as effective in the future as it has been in the past.