Perhaps the subject line should have read: Happy Old Year!

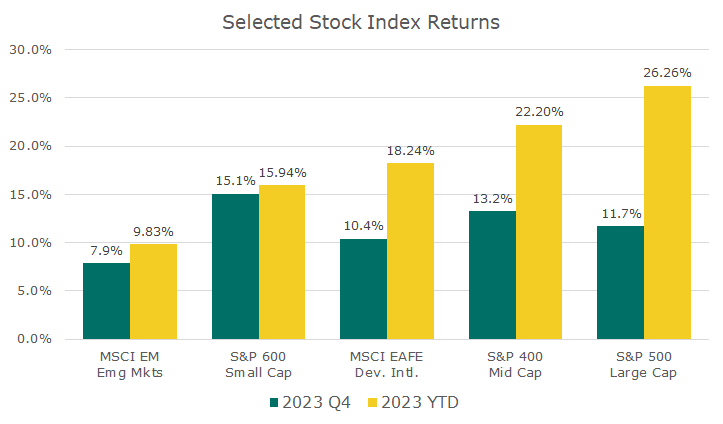

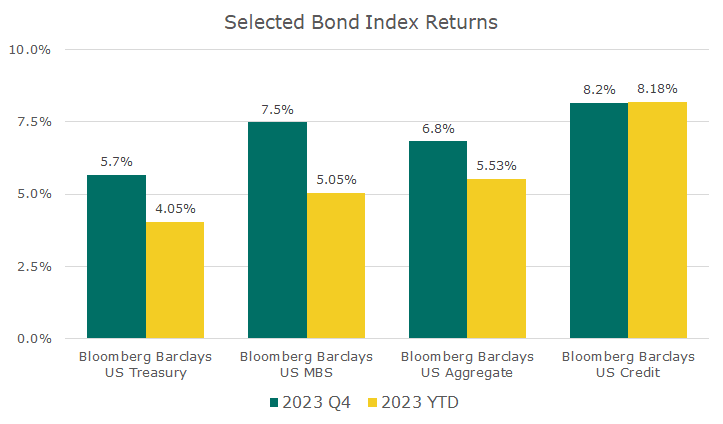

Today will be brief but take a moment to look at the charts below, which show the return for various stock and bond market indexes in the fourth quarter and for the year that was.

The worst major asset class return was just shy of 10 percent, and the best was more than 26 percent – a result that almost no one expected at the start of the year, or even three months ago.

Take a look at how much of the total return was earned in the last three months. For small cap stocks, 95 percent of the annual return was earned in the last three months. Don’t tell me you could have timed that!

Bonds worked out remarkably well too in 2023, but again, it was largely thanks to the fourth quarter. Virtually 100 percent of the returns on corporate bonds (labeled credit in the chart) was earned in the last three months.

The Aggregate index earned 5.5 percent for the year, and like Treasury and mortgages (MBS), MORE than 100 percent of the returns were earned in the last three months. That’s right, at the end of the third quarter, Treasury bonds, mortgages and the Aggregate were negative, but ended the year solidly. Another result that wasn’t predicted and would have been impossible to time.

“Buy and hold” can be so frustrating sometimes, but this is the time to remember that it really works.

One last fun fact before we go: The S&P 500 is about a half of a percent from its all-time high set in December 2021. More on that later though!

Happy Old and New Year!