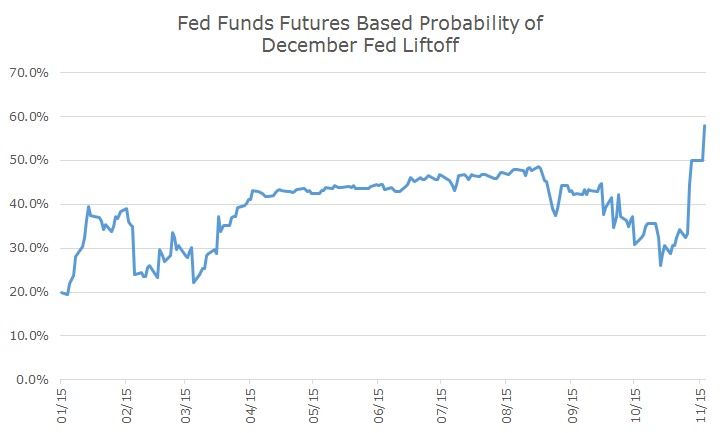

Yellen’s comments yesterday definitely had an impact on the markets view of what could happen to interest rates in December. The chart below shows what markets think are the odds of a rate hike at the December meeting since the beginning of the year.

You can see that at the beginning of the year, markets thought that the odds of a hike were not particularly high, ranging from 20 to 40 percent. As time passes, the odds approached 50 percent but then fell off after the September meeting. Then, based on the statement from the October meeting, the odds shot up to 50 percent and after yesterday are just shy of 60 percent.

At this point, the blue chip economists that are surveyed are now in agreement with the markets, unlike before when the economists saw a rate hike in September and markets didn’t.

The last survey by the Wall Street Journal of 60 economists found that 64 percent see a December hike, which matches the market view right now. Interestingly, the economists feel less strongly about December than they did about September.

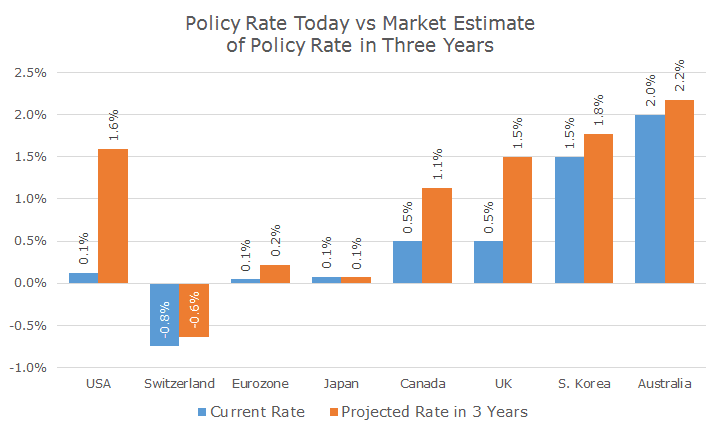

While I was looking at the data from above, I noticed a data series that I hadn’t seen before, which uses the same methodology to estimate future policy rates.

The table below shows the current policy rate in blue, and the market estimate of the policy rate three years from now. In the US, the Fed Funds policy rate is 0-0.25 percent and in three years, markets think that it will be 1.6 percent.

This isn’t to say that the market is always right in its forecast – quite the contrary, markets have predicted higher rates for the last 30 years while rates consistently dropped.

But still, it’s interesting to see what markets are expecting for rates around the globe. For example, markets think that rates in Switzerland will still be negative in three years, which I find amazing.

While our rates are expected to rise, markets think that they will stay flat in the Eurozone and Japan. South Korean and Australia are expected to see rate hikes, but not as much as in Canada and the UK.

I also find it interesting that rate expectations don’t cross the two percent threshold anywhere in the developed world except Australia (which is two percent now).

Indeed, markets expect relatively low policy rates for a few more years, which makes sense given that economies are expected to grow slowly and inflation expectations are subdued at best.

I should also point out that even though markets see rising rates, it doesn’t mean that we should get out of bonds. It’s true that rising rates hurt bond prices, but the chart above shows expectations for the short-end of the curve, not the middle where we invest.

It’s possible that the curve flattens, meaning that short rates increase while medium and long term rates stay the same. Of course, it’s also possible that longer rates rise more – the trouble is that we just don’t know.

I’m also convinced that we want rates to rise. While it may hurt in the short run, as long as your time horizon is longer than your duration (five years or so), you’re better off with higher rates.

I’ve said it before many times, rates this low are for the birds!