You may have noticed that the small cap index in the table above, the Russell 2000, has been gaining ground recently on the S&P 500, the benchmark index for large cap stocks.

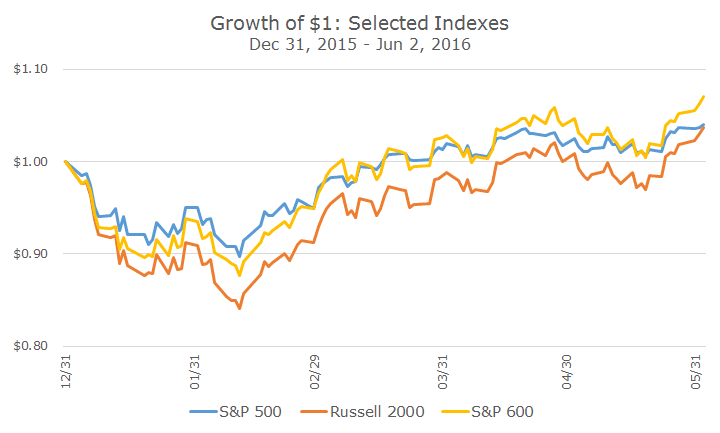

The chart below shows the return for the Russell 2000 (in orange) as nearly caught up with the S&P 500 (in blue). The return difference, as we can see in the table is just one-third of one percent, a substantial improvement from the five percent deficit we see back in February.

The yellow line is the S&P 600 Small Cap index, which is substantially outperforming both the Russell 2000 and the S&P 500. Although it’s a little hard to see in the chart, this index us up 6.8 percent for the year through yesterday.

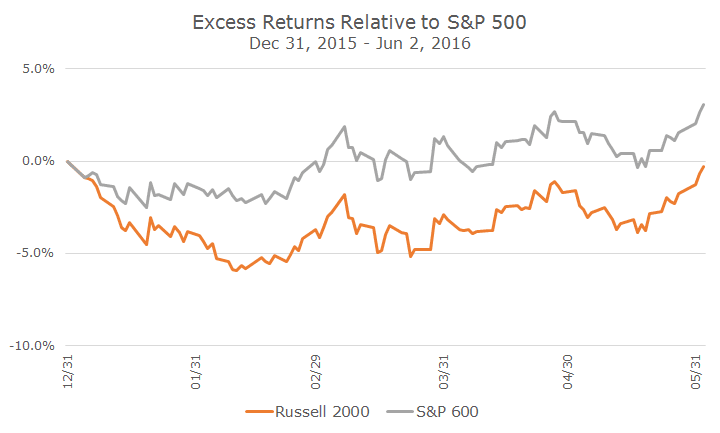

Because the distinctions can be hard to see in the above chart, I like to plot the ‘excess’ returns of the two small cap indexes versus the S&P 500, which we can see in the chart below. If I had been more clever, I would have made the gray line representing the S&P 600 Small cap index yellow to match the chart above.

In some ways, it’s surprising to see one small cap index outperform another one by more than three percent in just over five months, but it isn’t a complete surprise. Nearly two years ago, I wrote about the inferiority of the Russell 2000 small cap index (which you can find here).

Since the article two years ago, we’ve done some work that explains the difference in returns besides some technical construction details. The basic idea is that the S&P committee picks the stocks in the S&P 600 and favor high quality companies that tend to perform better over time.

This is good news, especially for the time being, but it’s important to note that quality stocks go out of favor from time to time, just like value, momentum and size for stocks and term and credit for bonds.

In the long run, we believe that the winning periods will more than pay for the losing periods, and since no one has the ability to time the factors, enjoy the good times while they last.

In other words, let’s be happy about the hay being made while the sun is shining, but remember these days when the strategy works against us.