As the S&P 500 continues to break new records, another asset class has handily outperformed the stock market so far this year: REITs. REIT is short for Real Estate Investment Trust and refers to securities (corporations or trusts in most cases) that own and operate income-producing commercial real estate.

REITs are an attractive way to build a diversified portfolio of commercial real estate since the barrier to entry for a diversified portfolio of actual commercial property is very high – and relatively illiquid, especially compared to REITs, which are highly liquid.

While the S&P 500 is up 9.54 percent (an outstanding return!), the Dow Jones Select REIT index is up 20.85 percent – more than twice as good!

What’s driving those terrific results? The same thing that’s pushing bond returns higher: lower interest rates.

Last year, when the Barclays Aggregate bond index dropped 2.02 percent as interest rates rose and the S&P 500 was up 32.38 percent, the same Dow Jones REIT index was only up 1.22 percent. It didn’t lose, but it was hardly anything to write home about.

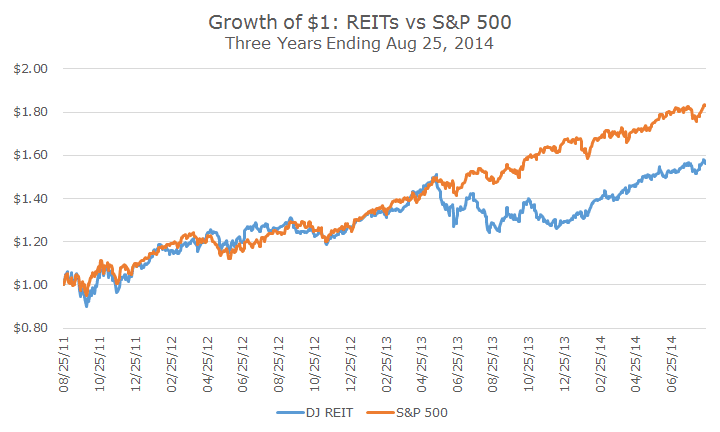

The following chart shows the results of the Dow Jones REIT index versus the S&P 500 over the last three years though yesterday.

You can see that the results follow each other closely until late spring of 2013 when REITs fell off and stocks continued their powerful ride higher.

That was about the time that the bond market had its so-called ‘taper-tantrum,’ when former Federal Reserve Chairman Ben Bernanke indicated that the Fed was ready to start tapering their monthly bond purchases. The stock market loved the news, but for bond and REIT investors, not so much.

REITS are a funny bird – they’re sensitive to both stocks and bonds factors. When we evaluate stock indexes, we look at their sensitivity to the overall market, size, value, momentum and quality. REITs have a lot of sensitivity to size, value and quality, but not momentum, which makes sense.

Unlike stock indexes, REITs are also sensitive to the two big factors that drive bond returns: term (or maturity) and default.

Unlike a stock or bond index, though, the model that we use does a relatively poor job of explaining the results. For a stock index, we usually find that the factors I mentioned above explain 95-100 percent of the returns. The same model (expanded to include bond factors) only explains 55-60 percent of the results, indicating that REITs are really their own asset class.

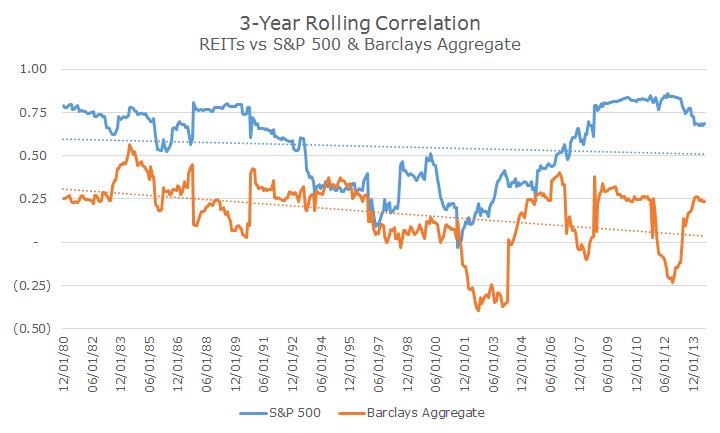

The fact that the model doesn’t work well suggests that the correlation between stocks and bonds should be low, and that has, in fact, been the case. The following chart shows the rolling three-year correlation of REITs to the S&P 500 and, separately, the Barclays Aggregate.

Note that the results are all over the board, which means that REITs still represent an attractive asset for the purpose of diversification.

Historically, REITs have outperformed the S&P 500, by about 0.75 percent per year since 1978. That said, the returns have been more volatile than the S&P 500, so when you do the statistical tests, you find that the extra return is not statistically significant – it could easily be a fluke resulting from a short (36-year) time period.

We do expect REITs to earn returns that are consistent with the overall market, mostly because it seems sensible that commercial property should continue to produce nice income and the value of the land and buildings should grow along with inflation.

That’s not a for-sure proposition, of course, REITs can suffer badly at times. The worst 12-month return for the S&P 500 since 1978 is -43.3 percent, but the REIT index fell 60.7 percent in one 12 month period.

When we allocate money to REITs, we take it out of stocks because the volatility is at least comparable. It would be a terrible mistake in our view to take money from bonds and invest in REITs for the extra income.

It’s true that the 10-year US Treasury is yielding 2.38 percent and the indicated yield on REITs is 3.62 percent, but that extra income comes with a lot of extra risk.

REITs are their own creatures – not stocks or bonds. We think it’s practical to maintain a small allocation to REITs over the long term due to their diversifying properties, attractive long-term expected return, and current income.