Market participants and the news media alike are focused on round numbers, whether it’s the hopefully forthcoming Dow 25,000 or the 10-year Treasury crossing three percent last week.

Amidst all of the news last week, one round number caught my eye: the unemployment rate crossing below four percent for the first time in nearly 20 years.

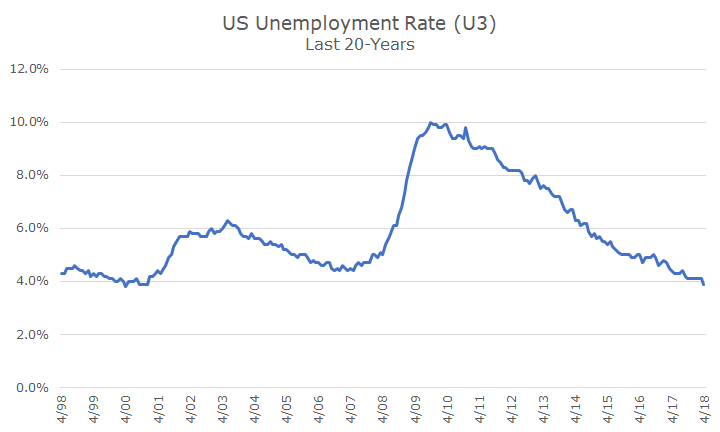

The chart above shows the unemployment rate, or, more officially U3, for the past 20 years. In the late 1990s and early 2000s, the rate was just below four percent, as it is now. Then the recession and 9/11 hit, and the rate jumped above six percent.

The rate fell slowly but surely until the 2008 recession, although it never went below four percent during that expansion. Then, the big crisis hit and it shot over 10 percent. Now, after eight years since the peak unemployment rate, it’s back down to almost where it started.

Although the headline is terrific, most economists will spend their time talking about structural changes to the participation rate (which now stands at 62.8 percent), about wage growth and the other part of the report that deals with the number of jobs created.

My though when looking at the chart is much simpler: we must be late in the economic cycle. Lay readers like you will say ‘duh’ and economists may debate whether we’re in the seventh, eighth or ninth inning, but it doesn’t really matter (and it’s impossible to tell anyway).

I thought about doing a more formal analysis of future returns based on the current unemployment rate, but I didn’t. My intuition was simple enough, which is that when the unemployment rate is low, it’s not a great entry point and that when the rate is high, it’s a better entry point.

Ultimately, I concluded that the analysis would support that hypothesis, but that the data was so short that it wouldn’t be a very robust analysis.

I’m reminded of a quote from one of my favorite articles of all time. Back in Oct 2008, Warren Buffett wrote an op-ed for the New York Times saying that it was time to buy stocks.

Among other things, he said that ‘equities will almost certainly outperform cash over the next decade, probably by a substantial degree.’ He then said that if you ‘wait for the robins, spring will be over.’

Almost ten years later, it’s pretty clear that he was right on the money. Over the weekend, at his annual meeting (also known as the Woodstock for capitalists), he was characteristically bullish on the long-term benefit of owning stocks.

While I agree 100 percent about the long-term benefit of stocks (especially when compared to cash and bonds), I also think that spring is over and summer is past too.

It’s fall and while we don’t know when winter will come or how sever it will be, it’s best to be prepared by making sure that your stock/bond mix is appropriate for you.

In the meantime, we can focus on the beautiful spring weather that we’re FINALLY enjoying here in St. Louis.