Stocks are suffering for two basic reasons: slowing global growth and tightening central bank policy. While both of these rationales are true, they’re also very generic.

Therefore, I thought it would be interesting to look at the big sectors driving the market performance and try to describe what’s happening in each one for a little more granularity.

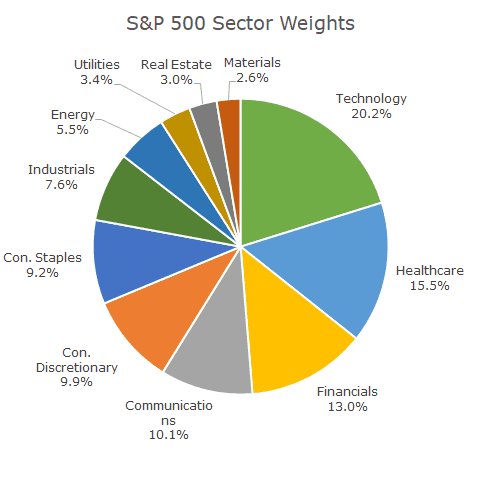

There are 11 sectors, and I won’t be discussing all of them, because some are so small that they don’t have much impact no matter what’s happening.

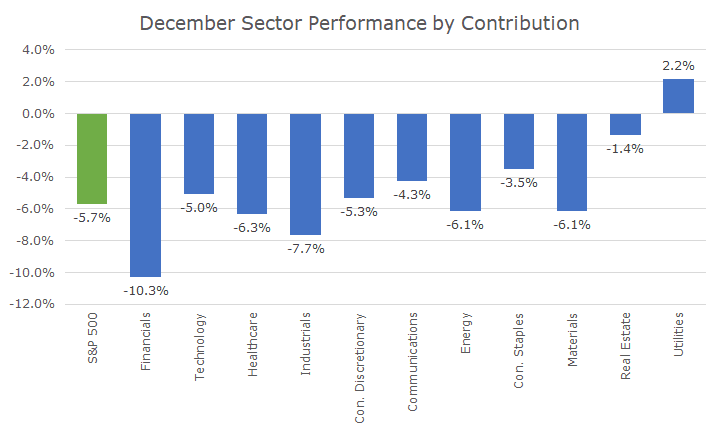

I thought it would be even more interesting to do an attribution analysis that looked at which sectors were having the most impact, which is a function of both size and price movement.

The chart below shows the performance of each sector this month by impact. For example, financials account for almost 25 percent of the loss this month even though they’re the third largest sector because they are down so sharply. Technology is much larger, but it isn’t down as much, so it only accounts for about 18 percent of the loss.

Financials

So, what is happening with financials? As I noted above, central bank policy is having a major impact on markets. In the US, the Fed has raised rates three times this year, bringing the overnight rate from 1.5 percent to 2.25 percent.

At the same time, the 10-year rate has not moved commensurately, rising from 2.71 percent to 2.91 percent, resulting in a flat yield curve. The spread between Fed Funds and the 10-year was 1.21 percent and is now just 0.66 percent.

Banks are the largest sub-sector and their basic business model is borrowing money at the short end of the curve and lending it out at the long end. If the difference in rates isn’t very high, their profits get squeezed, and you can see how the markets adjust for this.

Technology

Technology stocks are interesting, because it seems as though there is a change in sentiment that is driving valuations lower. It’s true that the trade conflict is raising input costs and putting pressure on overseas sales, but investors seem a lot less willing to pay the high prices that they did a few years ago.

The current consensus estimates for earnings growth is 13 percent in the coming year and nine percent after that. That’s a major slowdown from the 25.5 percent earnings growth for the last two years. As a result, the forward PE has dropped from 18x to 15x, a level not seen in for two years.

Healthcare

Heathcare was outperforming the overall market in December until Friday because, unlike some of the other sectors, there isn’t a very specific issue. Unlike technology, earnings growth is expected to pick up, but not as radically, from 11.7 to 14.1 percent.

Before Friday, valuations hadn’t changed much, but there was a stock specific problem that I can only hint at since it’s on our Approved List. I can say that the largest healthcare company in the world that makes everything from band-aids to drugs to talcum powder faces litigation risk that took the stock down ten percent, which brought the whole sector lower.

So, while we can’t attribute the sector decline to the usual suspects, it’s a good reminder that idiosyncratic risk is always an issue and it’s unwise to concentrate very heavily (even in one of the world’s most trusted brands, hint hint).

Industrials

It’s hard to imagine a sector that’s more impacted by trade since 45 percent of revenue for industrials comes from foreign sources. Global manufacturing largely remains positive, but the growth rates have slowed. In most countries, the Purchasing Manager’s Indexes (PMI) remain expansionary, but have fallen from their recent highs.

Consumer Discretionary

We should all thank the American consumer for keeping their wallets open and flowing. Consumer spending is high, along with consumer confidence, largely thanks to the decades low unemployment rate and higher wages.

Even though the holiday season is off to a strong start, the sector is weak, largely because Amazon has fallen sharply. I think of Amazon as a technology stock, but it’s almost of one-third of the consumer discretionary sector. Right now, though, it’s falling with the other FAANG stocks as multiples are falling.

Conclusion

Those five sectors add up to about two-thirds of the value of the S&P 500, and while the others are material, we’d find many of the same themes driving their prices.

It will be interesting to see what happens from here as these factors continue to weigh on the minds of investors.