A lot of our attention at Acropolis is focused on asset classes like US large or mid cap stocks, emerging markets or bonds. We also spend a lot of time researching and trying to optimize strategies like value, momentum, size and quality.

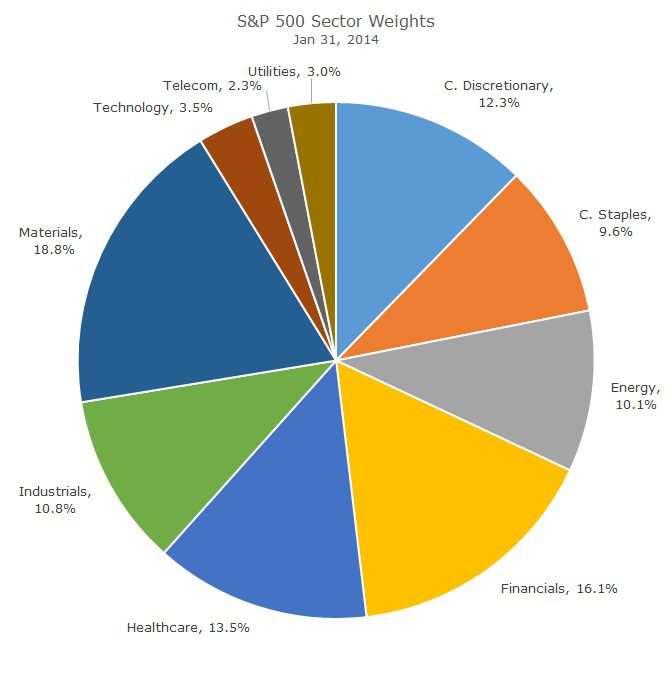

Another dimension that factors into our decision making process are stock sectors (bond sectors too, but I’ll save that for another day). Within the S&P 500, there are 10 sectors and their current weights according to S&P are as follows:

These weights shift over time. For example, 25 years ago, the technology sector was relatively small. In 1999, at the peak of the tech bubble, the technology stocks had a 40 percent weight in the index. Today, technology stocks are still the largest weight, but are a much more reasonable weight at 25 percent of the index.

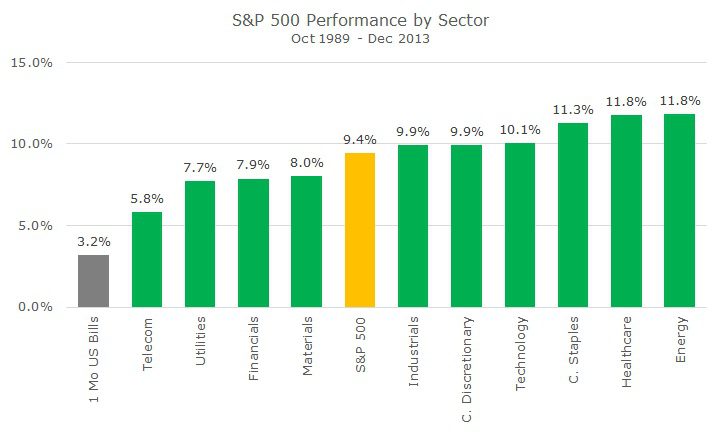

High quality sector data doesn’t go back very far, only to 1989 in fact. While that’s 25 years, we much prefer longer data sets to try and understand how much we observe reflects true, meaningful relationships and how much is just market noise.

Let’s take a look at performance of all ten sectors in the S&P 500 and see what relationships we can divine.

Since 1989, Consumer Staples, Healthcare and Energy stocks have outperformed the S&P 500 by roughly 2-2.5 percent per year. At the other end of the spectrum, telecommunications stocks have only outperformed one-month Treasury bills by 2.5 percent per year and underperformed the overall market by more than four percent per year (per year for 25 years!).

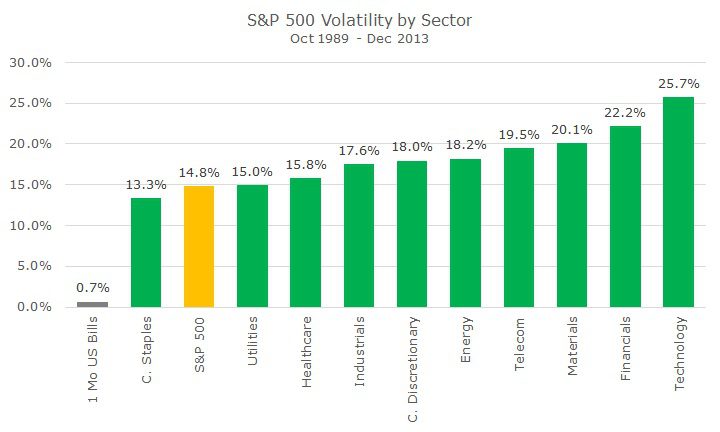

Of course, when we talk about returns, we always need to talk about risk. The next chart shows the volatility of each of the ten sectors and the overall S&P 500. Given the poor performance of telecom stocks, you would have hoped that they had low volatility, but they tended to be at the volatile end of the scale.

To me, the biggest take away from the chart BY FAR is that the total index is less volatile than nine of the ten sectors. When you think about it – it makes perfect sense – the diversification benefits and imperfectly correlated sectors lowered the risk of the whole portfolio.

We see this across all kinds of asset classes, sectors, subsectors (for stocks and bonds) and so forth. Diversification is a powerful risk reduction strategy. If you had to pick the one sector that was less risky than the overall index, would you have picked consumer staples? Maybe, but there’s a nine out of ten chance that you wouldn’t have.

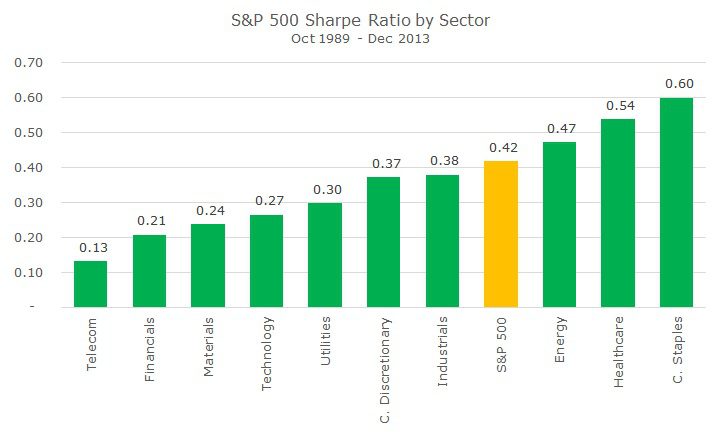

If we combine the performance and volatility chart, we get the sectors by Sharpe ratio. The Sharpe ratio looks at the return of an asset minus the risk free rate divided by the volatility of the asset. So, for the S&P 500, the return was 9.4 percent, the risk-free rate was 3.2 percent, and we get an excess return of 6.2 percent. Take that and divide by the volatility of 14.8 percent and you get a Sharpe Ratio of 0.42. For every one unit of volatility, there was 0.42 units of excess return. Higher is definitely better.

Seeing these three charts, should we invest all of our money in consumer staples with the best Sharpe ratio, energy stocks that had the highest return or something else?

This gets us back to the short time horizon. Statistically, because there just isn’t enough data, we can’t tell the difference between energy stocks and the S&P 500 (to pick the best performer). The academic data may exist to do this, but I haven’t seen it and when I tried to do a rough cut, the results just weren’t very strong.

If I can’t tell the difference between the returns in a strong, statistically way (the academics say ‘robust’), then we think it’s best to diversify since we do know statistically and otherwise that a portfolio of sectors will be less volatile than one sector alone.

So, when asking the question, which sector is best, I have that same lousy answer: it depends. If the question is, which sector performed best between 1989 and today, the resounding answer is energy. If the question is altered a little bit to best risk-adjusted results, it’s simply: consumer staples. If the question is which one will be best in the future? It’s hard to say.

When I think about which one is best, I think, ‘yes, they are’ and buy a diversified basket of them. We do have strategies for how to allocate them and there are some inferences that we can draw, but as you might expect, we will always end up with a diversified portfolio.