After quietly lying dormant for several decades, inflation is today’s big story in economics and markets. We all feel it at the grocery and pump, not to mention airline tickets, which are up more than a third from a year ago.

It’s also dictating central bank policy, here and abroad, and everyone is rightly wondering whether that central bank policy will push global economies into a recession if it hasn’t already.

About a month ago, I did a deep dive into inflation, which you can read here. I’m continuing with that deep dive this month, starting by looking at the inflation rates across the major categories. As a reminder, let me first show the weights of the major categories, and you can read more about them in the article I linked above.

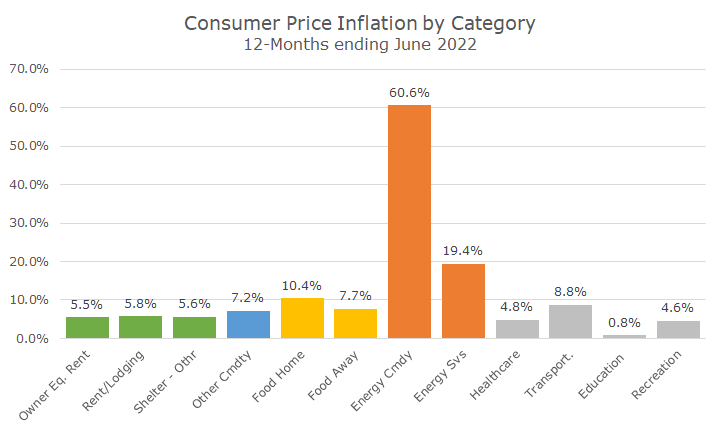

The overall inflation rate for the last 12 months was 9.1 percent, which shows the rate for each category.

You can see that housing is basically up 5.5 percent, other commodities like cars and clothing are up 7.2, food is 9.4 percent higher, transportation is 8.8 percent higher, but the big one is energy. Energy commodities (oil and gas) are 60.6 percent higher. Energy services (electricity and natural gas) are 19.4 percent higher.

While food and energy, the notoriously volatile components of inflation, are a real problem right now, you can see that inflation isn’t limited to those two. Outside of education costs, everything is up more than four percent from a year ago (who else is surprised to see low education inflation?)

The bond market is still signaling that inflation will get under control in the next few years. The ‘breakeven’ rate, which looks at inflation-protected and regular bonds yields, shows inflation expectations of 2.6 percent over the next five years. Another measure called the five-year, five-year forward shows 2.1 percent over the next five years.

Why the disconnect between what’s happening now and the next five years? I think it’s a few things. First, markets seem to think that even though the Federal Reserve was slow to act, they are raising rates sufficiently now to curb inflation. It takes time for higher rates to impact the economy,

Second, I think markets are pricing in a recession. If the economy contracts or substantially slows down, energy prices will fall (although not all the way that they might, given the Ukraine war). If a recession brings on higher unemployment, demand will fall and keep a lid on wage inflation.

If you’re wondering whether you should sell your stocks and bonds on the theory that a recession is coming, keep in mind that I wrote that markets are pricing it in. If a recession comes, that alone may not affect prices much more since today’s prices should reflect a recession.

Of course, the recession may be worse than markets now expect, leading to lower prices. However, it is possible that a recession isn’t on the horizon, or it’s so mild that markets reassess and prices go a lot higher than here.

Ultimately, I don’t think anyone can outsmart the markets. Studies have shown that famous investors like Bill Gross at Pimco, Peter Lynch at Fidelity, and George Soros at Quantum (I know many people don’t like Soros for his politics, but he’s still one of the best macro investors of all time), didn’t add alpha through market timing. If they can’t, I don’t think we can either.

Next week, I’ll cover the inflation rate that the Federal Reserve follows more closely than the Consumer Price Index (CPI). When inflation was benign, I didn’t think writing about Personal Consumption Expenditures (PCE) made a lot of sense.

Right now, though, it’s interesting because the Fed targets the PCE (though they are definitely watching CPI), and the PCE is lower than CPI at 6.3 percent. It’s easier to get inflation to two percent when you’re starting at 6.3 percent than at 9.3 percent.

But that’s a story for next week.