Back in March of last year, S&P and MSCI jointly announced that they would reorganize the Global Industry Classification Standards (GICS) so that REITs will be its own stand-alone sector instead of a component of financials.

Most of the time, S&P and MSCI are competing index providers, but for reasons that I don’t know, they have worked together defining sectors (10), industry groups (24), industries (68) and sub-industries (156) around the world.

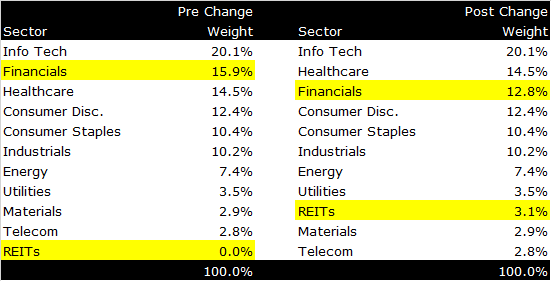

Real Estate Investment Trusts (REITs), which I wrote about here a few years ago, are currently included in financials, which are one of the 10 sectors. After the change at the end of August, REITs will be the 11th sector as we see in the table below.

Financials, which are now the second largest sector, will fall to third place and REITs will fall between utilities and materials. Note that the actual securities won’t change, and will only be reclassified.

I’ve read a number of articles (mostly from REIT purveyors) that suggest that the reclassification will increase demand for REITs. Their argument is that actively managed mutual funds are systematically underweight REITs and will have to adjust their holdings to more closely resemble benchmark weights.

I’m not so sure about this argument. In theory, active managers that aren’t worried about how closely they track the benchmark aren’t likely to do anything differently. The active managers that are worried about their benchmarks already probably own REITs as part of their financials exposure.

It’s possible that active managers are underweight because some investors, like Acropolis, view REITs as their own asset class and have more exposure than the overall market. Whether or not the under-weight active managers will feel compelled to buy and raise their valuation is an open question in my opinion.

For us, it doesn’t really change anything since we already have an independent REIT allocation and deem a 3.1 percent allocation (like REITs will be) too small for individual positions in our large cap exposure.

It’s possible that we’ve already felt the benefit of the reclassification: the MSCI REIT index is up 9.04 percent so far this year, compared to 3.14 percent for the S&P 500. That’s worked well for us, but it’s impossible to say what will happen after the change becomes official.