The other day, Michael and I were talking about stocks based in St. Louis and I remembered that Bloomberg had created an index of St Louis stocks.

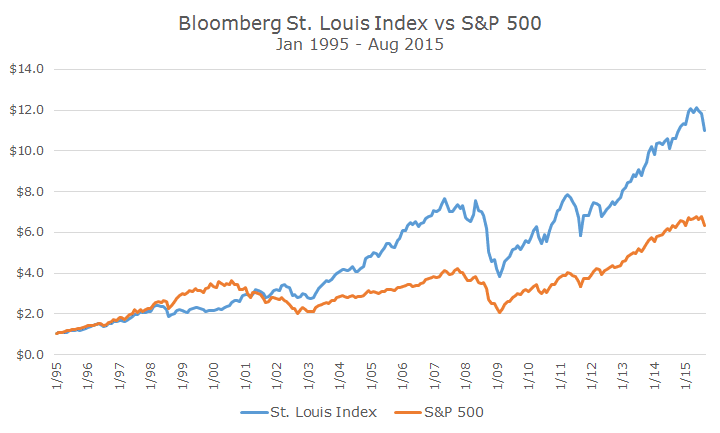

When I loaded the track record on the screen, Michael and I were pretty impressed: St. Louis stocks have done extremely well! The chart below shows the growth of $1 invested in the Bloomberg St. Louis index compared to a $1 invested in the S&P 500.

What you can’t see easily from the chart is that not only is the performance of the St. Louis index better, earning 12.8 percent versus 9.7 percent annually since the inception of the index, it’s done so with marginally more volatility.

My first thought was of a terrific article by the St. Louis Business Journal this summer (click here for the article) that said we have the same number of Fortune 500 firms that we did 10 years ago and they’re 132 percent bigger.

Over the years, I’ve heard over and over people lament the loss of corporate headquarters like Anheuser-Busch and May Department Stores. The article rightly points out that they’ve been replaced with companies that rank higher on the Fortune 500 list than the ones from 10 years ago.

Of course, I was wondering what the secret sauce was among ours stocks that created such terrific outperformance compared to the overall market, so I did a factor analysis that evaluated the performance of the St. Louis index compared to our old friends size, value, momentum and quality.

It turns out that the St. Louis index has a statistically significant relationship to all of the factors: St. Louis stocks tend to be smaller (between small and mid cap, often called ‘smid’ cap), trade at attractive valuations, have positive momentum and are high quality – some pretty nice attributes!

Furthermore, once you adjust for all of those factors, St. Louis stocks have a beta of 0.91, which means that they have lower than average volatility.

When I looked at the constituent holdings in the index, I found stocks that support what the statistics show; stocks like Panera Bread, Sigma-Aldrich, Monsanto, RGA, Express Scripts, and Centene.

As a lifelong St. Louisan, I have personal connections to all of these firms. For example, I remember when Panera had one location in Kirkwood and obviously just called it ‘Bread Co.’

But before we all get excited and decide to launch a St. Louis ETF (like the Nashville area ETF that I’ve written about previously that’s still on the ETF Deathwatch list), I found one reason for pause – the Bloomberg St. Louis index is price-weighted like the Dow Jones Industrial Average.

I’ve got a whole rant about that here, but basically, Panera Bread is 10.5 percent of the index because their stock trades at $182 per share, while Monsanto, a $43 billion company is just five percent of the index because it’s share price is $92.

Despite the goofy price-weighting scheme, it’s nice to see that the St. Louis index fares well against the S&P 500. It’s a great place to live and work, and, unfortunately, there’s no index for that.