This past Thursday, President Trump announced tariffs on Chinese imports citing security concerns and a significant trade deficit and estimated approximately $50-$60 billion in new tariffs. This was a follow up to his previous announcement of a 25 percent tariff on imported steel and a 10 percent tariff on imported aluminum. Following both announcements, stocks proceeded to sell-off on fears of a trade-war.

Since the simple act of increasing tariffs can touch an almost endless amount of factors, I thought I’d take a high level approach to get a better understanding of what’s going on today, by seeing what economics and history says about tariffs and trade wars.

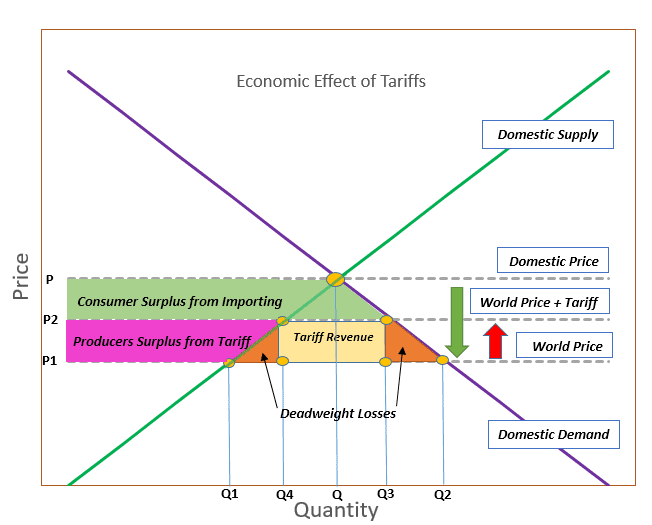

According to economic theory, tariffs hurt the overall economy because it benefits one specific group at the expense of multiple industries and the end consumer. More technically speaking, it causes deviations from natural supply and demand and creates deadweight loss. The graph below shows the theoretical effect of tariffs on supply and demand:

Ignoring transactions costs, at Q, you have the natural equilibrium for domestic supply and demand. When you open up to global trade, you have a lower price (P1) where domestic producers can only produce Q1 and domestic buyers can buy Q2 (the difference being made up by foreign producers). When you add tariffs, you increase the price to P2, raise the domestic supply to Q4 and lower domestic demand to Q3.

From the domestic producer’s perspective, this works out well, since they can create and sell more goods at a higher price. From the consumer’s perspective, it is a negative since the price has gone up. For foreign producers, it’s also negative since they are now selling less.

This first point is a part of why stocks would drop.

If you think of a sector like auto-makers in the context of a steel and aluminum tariff, auto-makers are a large consumer of these goods. According to basic economic theory, adding these tariffs will be a plus for steel and aluminum producers and a negative for auto-makers and end-consumers who will face higher car costs as an end result.

Unfortunately, in the real world, it’s not just that simple. Foreign countries are (for good reason) not going to like tariffs. In the past, there have generally been two reactions: Increasing their own tariffs (creating a trade war) or appreciating their own currency to weaken the dollar which increases their purchasing power and help negates the rising prices.

We have seen both of these effects within the past century.

Possibly the most famous (or infamous), is the 1930 Smoot-Hawley Tariff Act that raised tariffs to help protect American businesses and farmers during the Great Depression. This came eight years after a previous round of tariffs, known as the Fordney-McCumber Tariff of 1922, which led to a small trade war that hurt some individual sectors, but since the world was in a significant growth period, the effect was not as strong.

With the Smoot-Hawley tariff, like before, other countries raised their own tariffs. Because economies were already in recession, these tariffs helped contribute to a stagnation of global trade, causing the effects of the Great Depression to be prolonged.

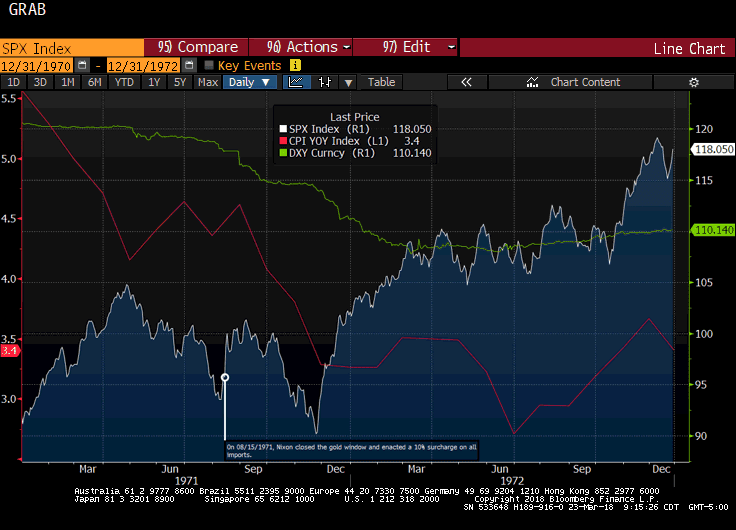

Fast forward to the 1970’s, we see Nixon introduce more tariffs when the US left the gold standard. We can see that in this case, the dollar depreciated, effectively negating the tariffs.

The callout point highlights August 15, 1971 when Nixon ended the ability to convert US dollars to gold and also enacted a 10 percent tariff on all imported goods. The green line shows the US dollar index relative to several major currencies and the pink line shows annual headline inflation.

In December of 1971, the tariffs were lifted and the dollar stabilized, but it was about eight percent lower than before. While the stock market (as shown by the S&P 500 Index) initially rose on the news of the tariffs implementation, it then proceeded to fall about 10 percent before rallying higher.

Moving forward to 2002, we can see a case that is similar to today, where President Bush enacted tariffs on steel imports:

The data callout highlights March 5, 2002 when Bush enacted the tariffs. Once again, we see the dollar depreciating, inflation falling, and the stock market falling as well. While the dollar continued to depreciate, inflation and stocks both rose after several months of declining.

Before going further, it is important to note that in each of the examples listed above, there was a lot (to say the least) going on in the economy that also played a major role in determining the value of the dollar, inflation, and the stock market. Earlier we had the Great Depression, then the US leaving the gold standard, and finally the tech bubble.

You don’t have to look very far to find something to be worried about today. The US is currently in the second longest bull market in recent history, the Fed is raising rates and unwinding its balance sheet, and volatility has seemingly returned to the market.

While economic principles and history both seem to show that raising tariffs and trade wars do not bode well for stocks, history has also shown that markets bounce back and that’s why we invest for the long run, not the day-to-day.

While it also may seem like this could be the trigger and it may be time to pull out, it is important to remember that markets are pretty darn efficient and the fears of trade wars have been priced in based on what we currently know.

We are also seeing that as the details emerge, more and more allies seem to be excluded from the tariffs, with the exception of China. Now China is no small country and the US trade deficit to China runs in the hundreds of billions of dollars (the market reflecting this fact with a 2.5 percent sell off on Thursday and a 2.1 percent selloff on Friday), but it is not the whole world and there are still many details that have yet to be ironed out (such as who will be exempt and what goods will receive the tariffs).

We don’t know how this will all play out, but we do know that these types of downturns have been factored into portfolio allocations and while it’s painful and stressful in the short run, it pays off in the long run.