Around this time last year and in the months to follow, you’d be hard pressed to find a news site, especially in the financial realm, that did not have an article about bitcoin or some other form of crypto currency or blockchain. Today, you’ll still see an article here or there, but by in large, the hype has subsided.

As we approach the 10-year anniversary of the publishing of bitcoin’s whitepaper by an anonymous user known as Satishi Nakamoto, I thought it’d be fitting to look back and see what has happened since Dave wrote about it (link here) back in August, 2017.

Personally, I found the whole craze quite fascinating. Seeing as I was only seven when the Dot-com bubble burst, this was my first real-life experience of a financial craze that everyone (ok not actually everyone) was buying, and only a fool would miss out on this opportunity of a lifetime.

For some, it actually was the opportunity of a lifetime and several became millionaires almost overnight. For many people (and probably a lot of millennials), it was an opportunity to lose lots of money. Hopefully for most people, it was a learning experience, either way, of bubbles and the risk of investing in the next big thing.

So, what happened?

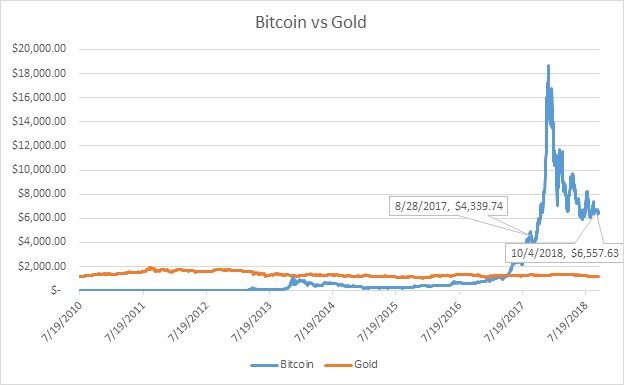

The graph above shows the value of bitcoin in US dollars. I add gold to the chart just to give a reference point of what a stable measure of money might look like. The first data callout shows the price of bitcoin at the time Dave wrote his article, the second callout shows the price as of this past Thursday.

Bitcoin’s all-time high at close was $18,674.48 on 12/18/2017. It fell more than nine percent the next day, and while it was a volatile trip down, it never fully recovered and is currently in a 65 percent drawdown.

The “first” specific sell off was triggered by the co-founder of one of the biggest bitcoin websites, announcing that he was selling all of his bitcoins saying the currency was “virtually useless.”

Since then, regulatory crackdowns have been the main tangible driver. However, panic selling, momentum effects, and people losing interest as the price continued to fall also played a large role.

Now if you went out and bought bitcoin after reading Dave’s article, you would still be up 51 percent, which is a pretty good return on investment for such a short time (assuming your bitcoins weren’t stolen and you didn’t forget your private key password). Unfortunately, that’s not the case for many people.

A Forbes article (link here) written a couple months ago documents some stories from Reddit users who tell their woeful tales of money lost betting on bitcoin. If nothing else, this is another great reason as to why you should always diversify your investments.

So, what now?

I think it’s worthwhile to revisit the definition of money to see whether anything has changed in regards to bitcoin. The three traditional components of money are a medium of exchange, a unit of account, and a store of value.

As Dave examined last year, bitcoin appears to hold up to the first two definitions’ pretty well and I would say it appears to be more common now than ever to be accepted in places, although I would not recommend ditching US dollars for bitcoin as I don’t think your local grocer is accepting them quite yet.

Regarding a store of value, bitcoin has been an incredible store of value, assuming you’ve held it from start to finish and didn’t buy it back when it was above $10,000. But the ride to get there has been bumpy, to say the least. Which, when you’re thinking about currency, a bumpy ride is not what you want.

Which leads me to say there is still a high level of uncertainty that bitcoin will continue to be a store of value, especially if you’re thinking of going out and buying some now. Currently, bitcoin is around $6,500 (give or take a couple hundred dollars). Whether bitcoin will be higher, lower, or about the same at this point next year (or even tomorrow), is a wild guess to me.

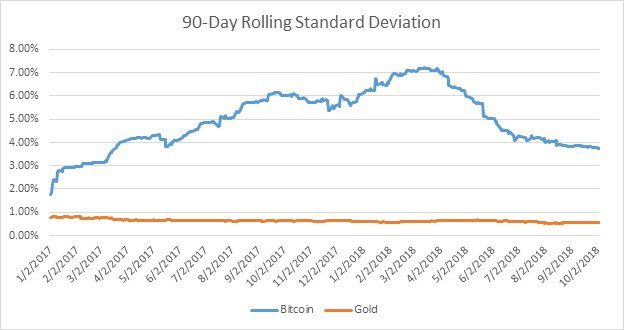

Whereas with gold, while there’s always a chance for higher volatility, I don’t think we will be seeing such drastic movements in either direction.

The chart above shows the rolling 90-day standard deviation of bitcoin and gold since the beginning of 2017. Seeing as at one point the standard deviation was above seven percent, four percent doesn’t seem so bad. But when we compare it to something more stable, like gold, which is below one percent, four percent is pretty high and definitely not something we’d like from a currency.

To sum up, by all definitions, bitcoin meets the definition of money. And while I think it is probably a better measure of money now than it was a year ago (due to better regulation, decreased volatility, and wider acceptance), I still don’t see it as replacing cash anytime soon; nor do I see it as a good investment.

Speaking of investments, it’s easy to look at the chart now and say “yes, that looks like a bubble.” And while in the midst of the run-up, there were many people who were saying it was a bubble, there were also many people who could tell (and still tell) really convincing stories as to why it was not, in fact, a bubble and would likely rise to $50,000-$100,000 per bitcoin.

Those people may have the last laugh if it does rebound and go that high, but that is a risk we don’t want to take with our portfolios.

History is full of examples of bubbles like this and stories of people who lost everything on the chance of a get rich quick scheme. The old adage of “if it sounds too good to be true, it probably is” still rings true today.

To be fair, history is also full of examples of companies and industries that have been phenomenal investments and there were and are many people who said Amazon would go nowhere. Maybe it is overvalued, but after reaching a valuation of more than $1 trillion, I think it’s safe to say it went somewhere.

But determining which assets are a bubble and which assets are going to be the next big thing is a very hard thing to do, which is why investors should stick to the well diversified portfolio. It’s boring, can go down, and will many times underperform single asset classes, like the S&P 500 Index right now.

But at the end of the day, it increases your chances of getting where you want to go by lowering the risk of loss and lowering the risk of being unable to stick with your portfolio and bailing when market goes down.

None of this information is new and Acropolis has been saying all this for a long time. But it’s always good to be reminded of it so that when those “opportunities” arise (like pot stocks right now, but that’s another article for another time), we can stay disciplined in our investing.