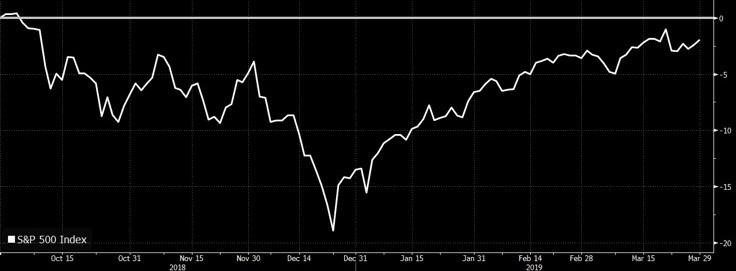

For the stock market, the first quarter of 2019 turned out to be the mirror image of the last quarter of 2018. Since hitting a low on Christmas Eve, there has been no looking back for the S&P 500 as it rebounded over 13% thus far in 2019, nearly erasing the bear market losses from the end of 2018.

Clearly, this renewed optimism in the markets is a result of booming economic data? Um… unfortunately, not. Economic production has slowed throughout the quarter, furthering a trend that began in late 2018. Sentiment and expectations of future growth continue to weaken as well.

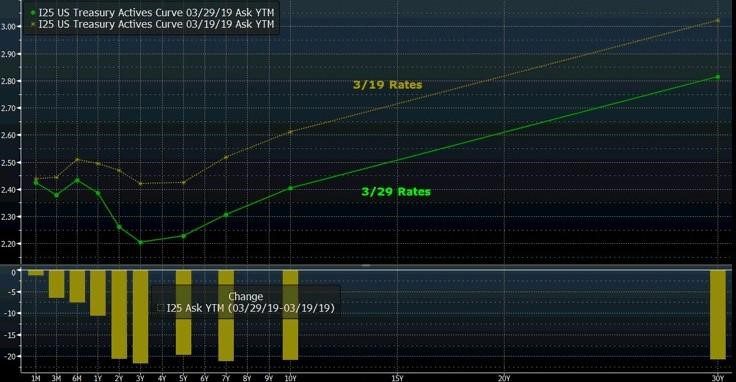

While stocks are trying to keep the party going, the bond market has been sobering this year. If stocks were flying high on a booming economy, we would expect interest rates to rise on increasing inflation expectations, therefore hurting bond returns. Instead, long term interest rates have plummeted, with Treasury bonds all the way out to 10 years trading at yields below the Fed Funds rate of 2.50%.

Last quarter, the yield curve was kinked… this quarter, it has fully inverted. As we have written in the past (here, and here), this matters because an inverted yield curve has preceded the past seven recessions.

Currently, stocks and bonds are pointing to drastically different futures. Stocks continue to trade at elevated valuations on expectations for continued growth. Bonds are signaling recession is on the horizon. The chart below illustrates this divergence. Typically, 10yr yields and stocks move in a similar direction. That has not been the case for this year.

This divergence can only be explained by one thing… the Federal Reserve. Since the financial crisis, the Fed has continued to be the driver of all markets. Last year, markets became concerned that the Fed was raising rates too aggressively, causing risk assets like stocks and corporate bonds to lose value. In early January, Fed Chair Jerome Powell made a stark turn in his remarks and began trying to soothe the market with talk of a temporary “pause” in rate hikes.

On March 20th, with the market anticipating this Fed “pause”, the Fed went uber dovish at its FOMC meeting, sending interest rates falling at a rapid pace. At its meeting, the Fed announced that it was not only pausing, but essentially told the market that this rate hike cycle was over through its forward guidance and interest rate projections. Additionally, it announced that it would permanently maintain a larger than expected balance sheet, therefore beginning to reinvest its bond portfolio in September. Either one of these announcements alone was more dovish than the market was anticipating. Together, they caused a massive adjustment to the expected future path of interest rates.

This is most easily seen by looking at the change in the shape of the yield curve. Yields on longer term bonds have fallen 20-25 bps over the final 8 trading days since the announcement (this is a MASSIVE move for bonds). The shape of this curve clearly shows investors’ expectations for lower interest rates in the future. After all, longer term bonds have more risk to investors. The only reason an investor would purchase bond that will pay 2.2% for five years rather than a bond that pays 2.45% for one year is because they believe rates short term rates will fall over the coming five years.

This view is confirmed in the futures market. Based on futures contracts prices, traders have placed a 77% chance that the Fed will not just “pause”, but will cut short term rates within the next year. Herein lies the explanation for this divergence in stocks and bonds… the Fed and their very large punch bowl.

The economy is slowing, both domestically and globally (which is much, much worse). The Fed acknowledged this by changing its policy. Bonds have responded by lowering yields in anticipation of future Fed action and slowing inflation. Stock investors see this coming, but believe the Fed will stave off recession. Lower yields and more cash sloshing around the system also point to increased earnings and higher stock prices.

This has been the cycle for the past decade and it appears to continue for now. We expect markets to remain volatile as they process not just the economic data, but the Fed’s expected reaction to the changes in data. Back in college, I had an economics professor always refer to then-Fed Chairman Alan Greenspan as the most powerful man in the world. After the recent market swings, Jerome Powell appears to have inherited that title.

The short summary: The economy is slowing. The bond market is forecasting recession. The Fed acknowledges this outlook. Stocks have faith in the now dovish Fed to limit the slowdown and get the boom going again. Stay tuned.